In this high-tech world, rearranging your personal finances is very important. This blog takes you through the way of finance management with the help of an app. These innovative tools empower individuals to effortlessly make the best expense tracking app, establish budgets, and strategize for the future, all through the ease of their smartphones. With just a few clicks, users can keep complete track of their finances despite life’s hectic pace, and the users can gain control over their financial well-being,

Table of Contents

Define Personal Finance Management App

A personal finance app is a mobile tool designed to assist individuals in effectively managing their finances. It provides various features like expense tracking, budgeting tools, bill reminders, investment monitoring, and setting financial goals. By offering these functionalities, these apps enable users to stay organized, track their spending, plan for upcoming expenses, monitor investments, and work towards achieving their financial objectives, all conveniently from their smartphones.

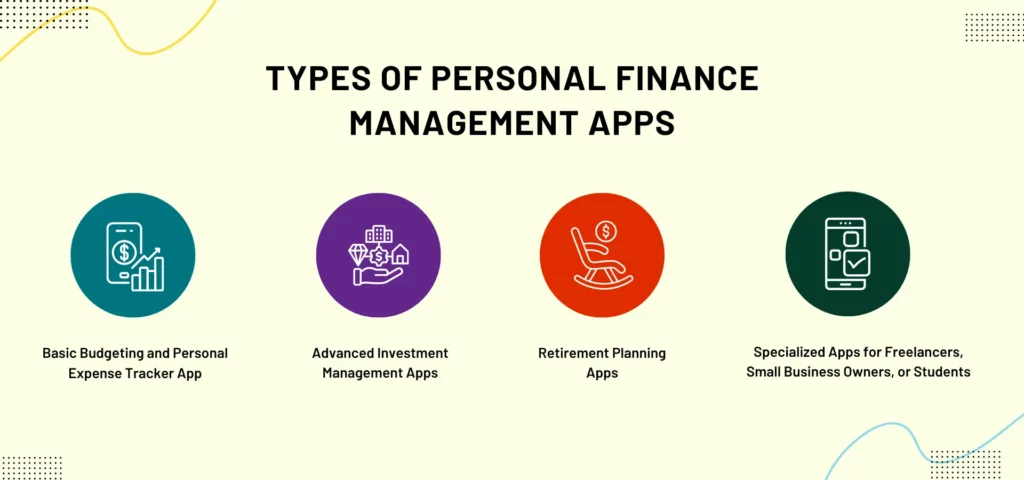

Types of Personal Finance Management Apps

Now you will get to know about the various types of personal finance management apps. Continue reading to get a detailed explanation of the types of finance apps. There are 4 types of finance apps given below:

Basic Budgeting and Personal Expense Tracker App

These apps are ideal for individuals looking to track their expenses and create basic budgets to manage their finances more effectively. They typically offer features such as categorizing expenses, setting spending limits, and generating reports to visualize spending patterns.

Advanced Investment Management Apps

Designed for users interested in monitoring their investments, these apps provide tools to track portfolio performance, analyze market trends, and make informed investment decisions. They may also offer features like real-time market data, investment calculators, and investment goal setting.

Retirement Planning Apps

Targeted towards individuals planning for their retirement, these apps help users estimate retirement savings goals, track progress towards those goals, and explore different retirement savings strategies such as 401(k)s, IRAs, and other investment options.

Specialized Apps for Freelancers, Small Business Owners, or Students

Personalized to the specific needs of these demographics, these apps offer features such as invoicing, expense tracking for tax purposes, business expense management, student loan tracking, and budgeting for education expenses.

Essential Features of a Finance Management App

Finance management apps have a great importance in this hectic pace of life for individuals, where they are unable to manage their finances based on their budget. So, here are some features of the finance management app given below:

Expense Tracking

These tools monitor your spending tracking habits by categorizing expenses and attaining insights into where money is spent.

Budgeting Tools

To limit your budget, you can set spending limits which will help you to stay within your budget. For example, if a person has the capacity to spend $15,00 per month, but he is unable to manage the expenses, these tools help in making the proper budget.

Bill Reminders

Receive notifications for upcoming bills, preventing late payments and fees. Every individual must get a reminder for every payment to ensure timely payment.

Financial Goal Setting

These financial tools have a capability to manage your goal and turn it into reality. Set goals like saving for vacations or debt repayment, with progress tracking.

Investment Tracking

Monitor investment portfolios and performance for informed decision-making. These investment tracking can develop a good habit of tracking every financial expense.

Reports and Analytics

Gain insights into spending patterns and financial trends through visualizations and reports. Based on the analysis you can even increase or decrease your expenses based on your requirement.

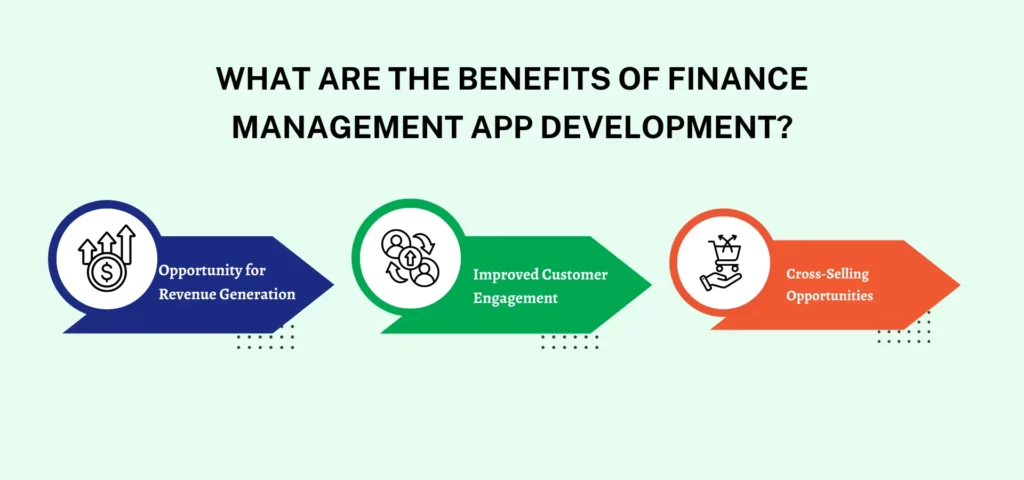

What are the Benefits of Finance Management App Development?

If you are still unsure about developing a custom solution, several benefits are given below to give you clarity.

Opportunity for Revenue Generation

The development of a finance management app can help you generate revenue through various means like affiliate marketing, subscription fees, and in-app purchases. With the expansion of the personal finance market, there is a significant opportunity for investors to earn profit in this field.

Improved Customer Engagement

The development of financial money management apps can improve customer engagement and loyalty for financial institutions. Financial management tools can also be very beneficial for financial institutions as these apps help strengthen a relationship with customers and increase customer retention.

Cross-Selling Opportunities

The development of these apps can also provide cross-selling opportunities to financial institutions. Based on the financial data of the users they can recommend additional financial products and services.

Development Cost of Personal Finance Management Mobile Apps

The cost of developing a personal finance software depends on various factors. However, the financial app is integrated with a variety of features. Here are some of the features given below that affect the cost of developing a personal finance app:

- Basic features

- Complex features

- Additional Features

- Size of the development team

- Area of Development Team

- Third-Party Integration

- Certification & Compliances

- Maintenance & Support

While building a personal fiancé mobile application various things come into mind like the platform of development, features, aesthetics, operations, etc. The majorly the cost of development is decided by the factors shown above:

The average cost of a finance application is given below.

To develop an Android app: Less than $2,000.

To develop an iOS app: $2,000 – $5,000

To develop a Windows App: The starting price is $3,000.

The basic feature finance app costs around $2,000 to $5,000. It takes around 1800 hours to 2500 hours to build these apps.

The time of development of the complex apps may even take months to build an app. Their cost of development also goes beyond $5,000.

So, you must take services from personal finance app development companies that are suited in some underdeveloped or developing regions to get cost-effective services.

Final Words

So, with this blog, you must have understood the importance of personal finance management app development. This personal finance app can do multiple tasks for you, it can manage and track your monthly or yearly expenses to keep your budget streamlined. It is the best money management app that makes it easier and allows the users to be in absolute control of their finances.

Frequently Asked Questions

A personal finance management app is a platform through which people can keep track of their expenses based on their monthly average budget.

There are different types of personal finance apps like budgeting and expense tracking, income and expense management, financial goal setting, debt management, savings, and retirements, and many more,

The main purpose of the personal finance app is to track and manage their expenses to meet their financial goals.

The cost of developing a personal finance app is not fixed as the cost may vary based on the functionalities and the features of the app.