A new technology of exceptional innovation and revolution inside the economic offerings zone has been delivered approximately by way of the together beneficial link between artificial intelligence (AI) and finance in the digital age. AI application in finance is now an important pillar for economic establishments everywhere in the globe. The integration of the AI era with economic operations has no longer most effectively decreased processes but additionally increased decision-making capabilities to formerly unheard-of ranges.

Table of Contents

Machine Learning Applications of Finance

Continue learning, to know about the applications of machine learning in detail like financial innovation driven by using machine learning and use of ML to optimize investment strategies.

Financial Innovation Driven by using Machine Learning

A key factor of synthetic intelligence, system gaining knowledge propels innovation in the financial industry in several regions. Financial agencies can now extract beneficial statistics from tremendous datasets through the use of its adaptive algorithms, which transform processes like fraud detection, investment strategies, and hazard management.

Using ML to Optimize Investment Strategies

Through the analysis of marketplace records, previous overall performance, and monetary indicators, gadget getting-to-know algorithms permit economic experts to optimize their investment strategies. These algorithms dynamically modify portfolios, minimizing dangers and optimizing returns in volatile market situations through superior predictive analytics.

Applications of AI in Finance: Driving Innovation and Efficiency

Artificial intelligence (AI) and device learning (ML) integration have grown to be a riding pressure on the back of efficiency and innovation in lots of operational domains in the banking industry. The application of AI in banking spans a large variety of use cases, from investment strategies and threat management to fraud detection and customer service. This allows them to find important patterns and insights that guide decision-making. These technologies facilitate techniques such as scenario analysis, optimization, and predictive modeling that improve operational operations and support strategic goals.

Artificial Intelligence-Driven Decision Assistance Technologies

With its superior analytics and insights from large datasets, artificial intelligence enhances financial decision-making processes. Financial professionals may make confident and quick decisions with the help of AI-driven decision support systems, which maximize risk management and investing strategies.

AI-Based Task Automation for Routines

Financial organizations may streamline operations and increase efficiency by using AI technologies to automate regular processes. With AI-driven automation, manual labor is reduced in a variety of tasks, from data input and reconciliation to customer support contacts, freeing up staff members to concentrate on strategic goals and value-added work.

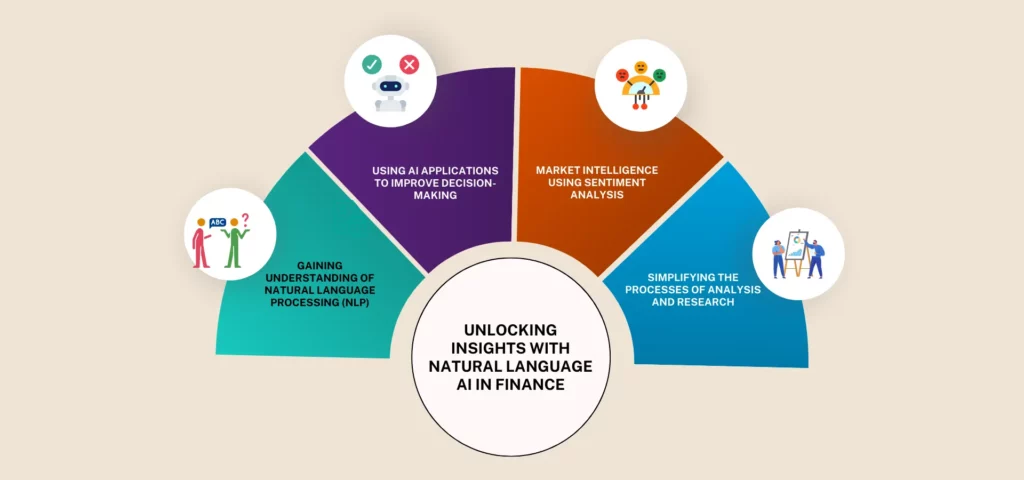

Unlocking Insights with Natural Language AI in Finance

Artificial intelligence (AI) technologies, especially in the form of apps, have transformed several aspects of the banking business, which is a dynamic terrain. Among these uses, natural language artificial intelligence (AI) stands out as a game-changer because it allows financial institutions to glean insightful information from textual sources like financial reports, social media feeds, and news articles. Let’s discuss some more about this below:

Gaining Understanding of Natural Language Processing (NLP)

AI solutions for herbal language processing (NLP) glean insightful statistics from unstructured textual statistics resources in finance, which include economic reports, information articles, and social media feeds. Through sentiment analysis, statistics extraction, and sentiment interpretation, herbal language processing (NLP) technologies allow financial analysts to make information-driven selections and acquire a radical draw close of marketplace dynamics

Market Intelligence Using Sentiment Analysis

Financial businesses may correctly measure marketplace sentiment and public opinion through sentiment analysis, a subset of natural language processing. Financial analysts are capable of expecting marketplace movements, and altering investment plans by way of examining sentiment tendencies and recognizing popular topics.

Using AI Applications to Improve Decision-Making

AI equipment permits finance professionals to confidently and precisely make data-pushed choices. Analysts may additionally acquire actual-time statistics, do sentiment studies, and determine marketplace sentiment employing synthetic intelligence packages. This permits them to make informed choices about investment techniques, chance management, and portfolio optimization.

Simplifying the Processes of Analysis and Research

Financial establishments’ research and analysis strategies are streamlined by using synthetic intelligence apps. Through the automation of tactics like records collecting, sentiment analysis, and trend detection, those applications enhance productivity and precision, liberating up analysts to pay attention to high-cost responsibilities like method formulation and purchaser interaction.

Advantages of Financial AI Applications

Below are the various benefits of Financial AI applications such as risk mitigation, improved decision-making, and cost reduction, and Personalized Monetary Advice.

Improved Decision-Making

AI structures provide monetary experts with insightful facts and predictive electricity, empowering them to behave quickly and conclusively.

Risk Mitigation

Financial establishments may additionally examine and mitigate dangers, and protect their investments and assets, with the resources of AI-powered threat management systems.

Cost Reduction

Financial establishments may additionally more successfully install assets when regular processes are computerized via AI technologies, which lowers their operational expenses.

Personalized Monetary Advice

Personalized monetary advice, suggestions, and guide services are only a few ways that AI-driven personalization improves the general customer level.

Examples of AI Financial Application

AI is used at various platforms and in various approaches, form buying and sling, sunding analysis. So, here are a few examples of AI financial applications.

ZestFinance

Focused on credit underwriting, ZestFinance applies AI and gadget studying fashions to exactly determine creditworthiness. ZestFinance offers creditors greater thorough hazard reviews so they will make better lending selections with the aid of inspecting non-conventional traits and one-of-a-kind information resources.

Ayasdi

AI-pushed monetary offerings answers, including fraud detection, anti-cash laundering, and regulatory compliance, are furnished via Ayasdi. Its software helps establishments discover and prevent fraudulent activities even preserving regulatory compliance by using device mastering algorithms to locate problematic patterns and abnormalities inside financial information.

These illustrations show how AI is being used in finance in loads of approaches, from buying and selling and funding analysis to change management and regulatory compliance. There are infinite opportunities for innovation and development inside the monetary zone as AI technology develops.

Final Words

Artificial intelligence (AI) technology was integrated into the changing banking zone, sparking a surge of efficiency and innovation. By maximizing investing techniques and enhancing chance control, gadget learning (ML) algorithms propel economic innovation. AI-powered decision-assist tools expedite strategies and permit monetary experts to make properly informed selections speedily. Sentiment evaluation using natural language AI transforms market intelligence by revealing insights from textual assets. Along with improving selection-making, those tendencies help store working costs and minimize hazards. AI has several uses in finance, from credit underwriting to regulatory compliance, as proven by way of organizations like ZestFinance and Ayasdi. Utilizing AI, DQOT Solutions improves danger management strategies, streamlines economic tactics, and spurs enterprise innovation. Modern AI-driven gear and services are furnished through our team, which allows economic institutions to stay aggressive and regulate the desires of a market that is changing fast.

Frequently Asked Question

AI in finance plays a crucial role and helps drive insights for performance measurement, predictions and forecasting, customer servicing, intelligent data retrieval, data analytics, real-time calculations, and many more.

AI is available 24*7 to solve your queries without any breaks. AI reduces the time taken to perform the task. It helps people become multi-tasker. AI enables the execution of hitherto complex tasks without significant cost outlays.

The cost of developing an AI application depends on various factors like features, complexity, development process, area of development, and many more.